Invogen’s Merchant Cash Advance Platform for MCA Funding Companies:

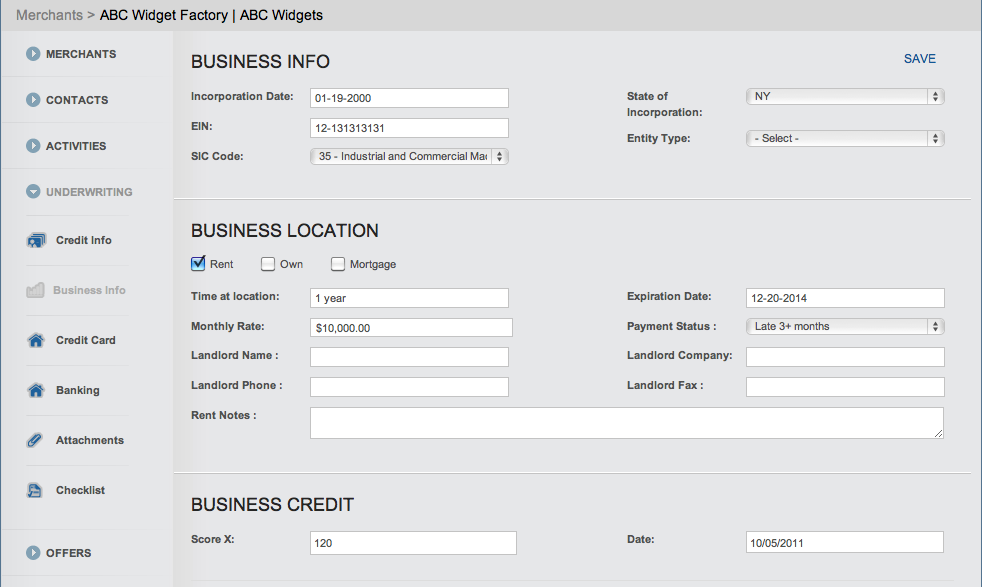

Funding companies bear the risk of buying future receivables from merchants at a discounted price. Therefore, funding companies must assess the merchant’s business viability through several methods, including monitoring credit card transactions, evaluating credit worthiness with existing creditors (such as landlords and vendors), and examining the business’s cash flow. Furthermore, funding companies must review the business principals’ financial and legal obligations. The Invogen MCA Platform manages the entire MCA underwriting process by collecting and organizing information from merchants, namely :

- Principals’ credit scores and personal liabilities

- Monthly credit card transactions and bank account information

- Landlord and vendor information

- Existing advances and legal obligations from the business

- Detailed checklists keep track of all this information, thereby ensuring completeness and accuracy of the underwriting process.

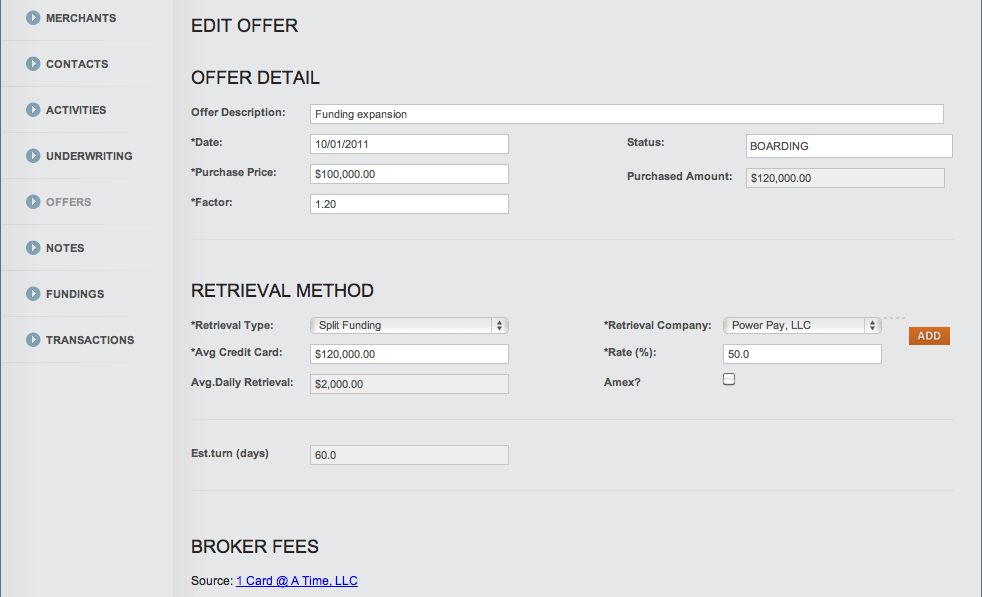

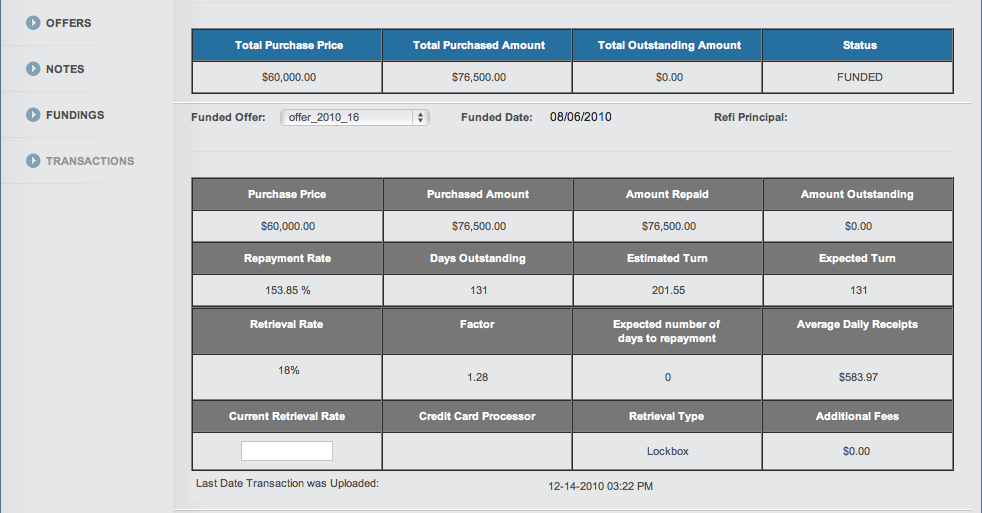

Funding companies make multiple offers to merchants based on set variables, such as factor/interest rate and expected turn-time for repayment. The Invogen MCA Platform allows funding companies to input these variables and easily make multiple offers to merchants. The Invogen MCA Platform also tracks the status of each offer before the merchant makes a decision. Once the merchant agrees to an offer, the Platform can begin accepting transactions from payment processors, lockbox companies and other third-party vendors to manage the merchant payoff process.

Funding companies typically work with multiple MCA brokers to acquire the best candidates for funding. As a result, funding companies generally want to measure the broker relationship and track each broker’s value to its business portfolio. The Invogen MCA Platform offers funding companies the ability to manage their relationships with brokers by allowing metrics to be set and measured for each broker.

Funding companies have investors who invest a fund or multiple funds. Investors are able to enter into a contract or purchase a note from the funding company with a set interest rate and investment schedule. The Invogen MCA Platform helps funding companies track these investments and manage the interest-payment and note-redemption processes.

With the Invogen MCA Platform, funding companies can offer merchants the opportunity to view their daily balance and payoff amounts in case a merchant wants to buy back its receivables in advance. This is one of many ways the Platform provides visibility and transparency throughout the MCA process (from underwriting to repayment).